Part 2 of 4: Church Governance Series by Msgr Philip Heng

Financial Governance: Where Canon Law Meets Civil Law

The first issue of this series on Church governance looked at canon law and the governance structure of the Church. In this second article, Msgr Philip Heng focuses on the financial governance of the Church, and describes how secular and management constructs are being employed to enhance financial governance.

When the disciples were first sent out in pairs to proclaim the Kingdom of God, Jesus had instructed them, “Take nothing for your journey, no staff, nor bag, nor bread, nor money—not even an extra tunic. Whatever house you enter, stay there, and leave from there” (Lk 9:3-4).

In the same manner, the Catholic Church today continues to depend on God to provide, often through the generosity of His people as empowered by the Holy Spirit, for the resources necessary to carry out its mission to “make disciples of all nations” (Mt 28:19).

But with the growth and scale of the Church, how can it ensure that the material resources provided for its mission are truly and properly used for this purpose? This is where the financial governance of the Church comes in.

In every diocese around the world, including Singapore, financial governance follows the norms set out in canon law. Additionally, each diocese may enhance its financial governance with professional management and other legal constructs available in civil law.

CANONICAL NORMS

In canon law, it is the diocesan bishop who governs the particular church entrusted to him with “legislative, executive, and judicial power according to the norm of law” (Can. 391 §1).

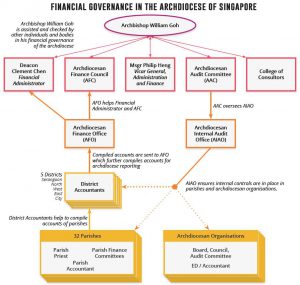

For the Archdiocese of Singapore, this means Archbishop William Goh has the ultimate authority in its financial governance, since he is the one able to exercise judicial authority.

While Archbishop William has the responsibility “to exercise vigilance so that abuses do not creep into ecclesiastical discipline, especially regarding… the administration of goods” (Can. 392 §2), he is also both assisted as well as checked by a few other individuals and bodies in this regard.

In each diocese, canon law also requires that the diocesan bishop appoints a vicar general (Can. 475 §1), a financial administrator (Can. 494 §1), a finance committee (Can. 492 §1), and a college of consultors (Can. 502 §1).

In the Archdiocese of Singapore, there are two vicar generals who take on different sets of tasks to cater to the size of the archdiocese. They are Msgr Ambrose Vaz, vicar general for pastoral matters, and Msgr Philip Heng, vicar general for administrative and financial matters. The vicar generals have “the executive power over the whole diocese which belongs to the diocesan bishop by law” (Can. 479 §1).

In Singapore, the finance committee is known as the Archdiocesan Finance Council (AFC). Its seven members, including the archbishop, meet monthly to review the archdiocese’s finance related matters.

Each year, it is the responsibility of the AFC to prepare a budget of income and expenditure for the whole diocese, and to review the financial results of the archdiocese for the end of the year (Can. 493 §1 and §4).

The financial administrator is Deacon Clement Chen. His duties, together with his staff, are to “administer the goods of the diocese under the authority of the bishop in accord with the budget determined by the AFC and, from the income of the diocese, to meet expenses which the bishop or others designated by him have legitimately authorised” (Can. 494 §3).

The AFC and the financial administrator (an ex officio member of AFC) ensure that the accounting and treasury needs of the archdiocese are properly and professionally managed. They are supported by the Archdiocesan Finance Office (AFO), which comprises four fulltime accountants and finance staff.

The College of Consultors consists of no fewer than six, and no more than 12 priests of the archdiocese. All are appointed to the college by the diocesan bishop for a term of five years, and the college has all the authority given to it by law (Can. 502 §1).

One of such laws requires the bishop to consult the AFC and the College of Consultors for financial matters of “major importance” and require their consent for “acts of extraordinary administration” (as defined by the Episcopal Conference) (Can. 1277 §1).

PARISH NORMS

Similar to how the archbishop holds authority over the financial governance of the archdiocese, parish priests are given authority over the financial governance of their respective parishes. Each parish priest is similarly assisted by a parish finance committee.

The Parish Finance Committee is “governed, in addition to universal law, by norms issued by the diocesan bishop”, in which a group of Christian faithful selected according to the same norms, “are to assist the pastor in the administration of the goods of the parish” (Can. 537).

In Singapore, a parish finance committee is typically made up of several lay faithful professionals (accountants, lawyers, other professionals), and assisted by a part-time or full-time accountant. The latter works closely with one of the District Accountants. The five District Accountants work together to oversee the overall financial statements of the archdiocese.

ENHANCING FINANCIAL GOVERNANCE

As an exempt charity, TRCAS (the legal entity under which the Catholic Church is established in Singapore) is currently not required to have its accounts audited and published. However, TRCAS has been submitting the accounts of its parishes to the Commissioner of Charities to provide greater transparency. Parishes have also been disclosing to their parishioners their income and expense statements since 2016.

The archdiocese has decided to adopt Charity Accounting Standards (the approved accounting standard for the charity sector, developed based on Financial Reporting Standards) from financial year (FY) 2017 onwards.

The accounts of all parishes and that of the archdiocese and its organisations will be migrated over to the new accounting standards so that aggregated financial statements can be produced and presented. Much work has been undertaken since 2016 to prepare parishes and the many archdiocesan organisations for this major change. Many volunteers have been mobilised for this process.

The archdiocese has also recently appointed Ernst & Young, a public accounting firm, to audit its accounts for FY2017. The archdiocese will also be providing an annual set of statutory audited financial statements to the Commissioner of Charities from FY2018 onwards.

The archdiocese has also set up an Archdiocesan Audit Committee (AAC). The AAC, which reports directly to the archbishop, exercises oversight over the archdiocese’s financial control, regulatory compliance and reporting risks, and audit matters.

The AAC will also be setting up an Archdiocesan Internal Audit Office (AIAO). The AIAO will conduct periodic audits to ensure that adequate financial and internal controls are in place across the parishes and all archdiocesan organisations (including those separately legally registered), and that they are adhered to. Given the number of these organisations, the AIAO will be prioritising them in its internal audit review cycle.

I believe, with the guidance of the Holy Spirit, the servant leaders of the Church will remain persistently vigilant in ensuring the proper use of our Church’s resources to spread the Good News of God’s love and Salvation.

Our Lord is truly stirring growth in our archdiocese; as so many changes are happening and plans underway. Today, I urge all Catholics to continue praying, getting involved, and supporting the plans that God has for us in His Church.

This is the second article in a series on Church governance by Msgr Philip Heng.

To read his other articles, click on the following:

- Part 1: Structure and Governance of the Catholic Church in Singapore

- Part 3: Fundraising for God’s Work

- Part 4: Protecting the Collection and Use of God’s Resources

Clarice Chan, Chairwoman, Original Minds Group

Clarice Chan, Chairwoman, Original Minds Group

Producer-Presenter, CatholicSG Radio

Producer-Presenter, CatholicSG Radio